Our Simulation & Results Output

How are our comparison results generated and presented?

We’re so glad you asked - let’s nerd out for a minute!

Here are the basics:

Pooling our insider knowledge over many months of collaborative work, our team has developed proprietary statistical simulation software specifically developed to capture the multitude of input variables involved with trading prop firms. This sim application allows us to provide an astounding apples-to-apples comparison between hundreds of account purchase options.

Input variables are set to conform to each firm’s rules and account parameters. These include things like Max DD, DLL, Consistency%, Profit Target, Payout Amounts, Profit Split, Sale Discounts, and much more. Where these are undefined or flexible, standardized values (based off of “industry standard” norms) are plugged in wherever possible to ensure fair, equivalent comparisons across all firms and account types.

We use a basic proprietary trading strategy to generate sim results, but here’s the beauty of the system: It does not matter what YOUR trading strategy is - despite the details of individual strategies, the comparison results hold. Remember, this is a “ruler” and not a “calculator,” so the simulated strategy is largely irrelevant as long as all firms/accounts are measured by the same ruler! Our simulation software simply uses a pre-defined, across-the-board strategy to generate the results we post, ensuring that you get a completely balanced scorecard approach with unbiased rankings across all firms.

We simulate using what we consider a typically normal amount of account purchases for full-time prop firm traders in one month. For eval based accounts, this sample size is currently set to 60; and for Straight To Funded accounts, the sample size is set at 20 (i.e. this makes up the “set number of accounts” referenced below). Simulation runs currently consist of 10,000 samples of the appropriate sample size based on account type being analyzed. Even if your personal purchases differ here, that’s totally fine - it doesn’t make the results invalid at all! For the sake of statistical analysis, we just feel that this gives a good, realistic baseline to work with.

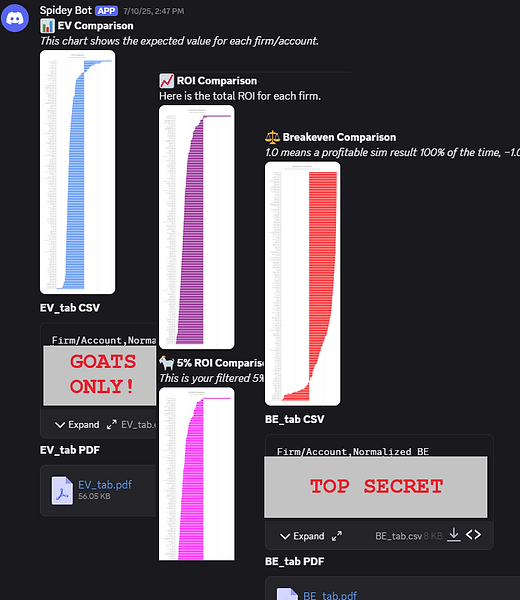

Results are then normalized on a 0 to 1.0 scale across all firms to provide our members with an easy-to-read data set, presented in charts and tables. Actual dollar and percentage values will differ by trading strategy, so we normalize the results to ensure that everyone should experience roughly the same comparative results within their strategy’s unique potential. It’s simple - just plug in YOUR trading strategy, and know that you’re getting the best bang for your buck by using our sim results.

No more guessing, no more subjective reviews, no more questionable recommendations, and no more blind trying!

We currently offer the following statistical results comparisons and rankings on all firms:

-

EV = Expected Value over the set number of accounts.

-

ROI = raw Return On Investment over the set number of accounts.

-

5% ROI = in plain English, you can expect to make this ROI (or better!) 95% of the time you purchase the set number of accounts.

-

Breakeven% = in plain English, this is the chance you have of losing money over the set number of accounts.

-

Avg Days To Payout1 = the number of days on average, when accounts are purchased one at a time and traded start to finish, to reach Payout1.

-

Cash Velocity = this is simply the amount of Payout1 divided by the Average Days To Payout1.

Joining us at just the basic Member Patreon tier gets you access to ALL of these metrics and comparison results, updated twice weekly, plus other (seriously) helpful tools developed by our veteran staff that will have you ready to tackle the trading week - every week!